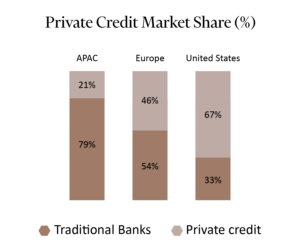

Corporate lending in Australia has historically been dominated by traditional banks, despite non-bank lenders taking up a larger share in international markets.

Currently, private credit comprises ~21% of total lending in the Asia-Pacific (APAC) region relative to 46% and 67% in Europe and the United States[1], respectively – indicating a significant growth opportunity for the regional asset class.

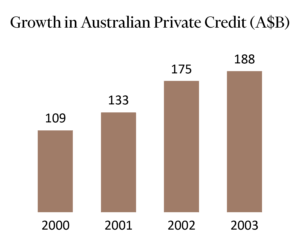

By 2023, the Australian corporate private credit market had grown to around $188 billion, expanding at an annualised growth rate of approximately 20% since 2020.

What is corporate private credit?

Corporate, private credit involves a lending agreement negotiated directly between an operating business and a non-bank financier (such as Wingate). Relative to public bond markets or traditional bank lending, it typically features highly tailored terms and covenants to meet borrowers’ requirements. Whereas real estate credit is secured against the underlying land or property, corporate credit is secured against the assets of the corporate entity (inventory, equipment, property, etc.) with cashflows generated by the company used to service the debt.

Against a turbulent macroeconomic backdrop, floating-rate corporate private credit continues to attract investors seeking defensive allocations, lower volatility to public markets and outsized risk-adjusted returns supported by numerous downside protection mechanisms (e.g. asset collateral, security structures, covenants, equity buffers and control triggers).

Since the Global Financial Crisis (GFC) in 2008, corporate loans that were traditionally issued by Australian banks have been gradually shifting toward alternative sources of capital. This trend is driven by stricter regulatory capital and reporting requirements for both Australian and global authorised banks.

According to the Reserve Bank of Australia (RBA), around 15% of loans to small-to-medium enterprise (SME) borrowers now come from non-bank sources.

While corporate private credit is a relatively nascent asset class in Australia, Wingate is one of its longest-standing local managers and is well-positioned to capitalise on the near-term opportunity.

Opportunities for Wingate Corporate Investments (WCI)

The pullback in traditional bank corporate lending has created opportunities for WCI. We have seen a strong demand for capital from corporations that do not have access to more traditional financing due to a range of factors.

For example, WCI recently deployed $45m into a senior secured syndicated facility with a leading equipment rental business to refinance existing debt. The business specialises in supplying equipment to Australia’s resources and mining sector, generating FY23 earnings of ~$155m with an expansive equipment fleet valued at over $200m. The business is owned by a reputable global financial sponsor with ~US$3b under management. WCI invested alongside a syndicate of global investment banks and fund managers.

The investment is expected to generate an approximate IRR of ~13.5% p.a.

[1] Bank of Internal Settlements, 2023.