Launched in August 2020, WCCF1 was Wingate Corporate Investments' (WCI) first dedicated corporate private credit fund.

In August 2024, the final investment was fully repaid, crystallising net annualised returns of ~11.2% p.a. for investors (pre-tax, post all fees), exceeding the initial 10% target return. This net performance implies a ~10.1% margin over the average one-month bank bill swap rate during the applicable period.

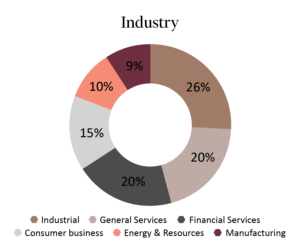

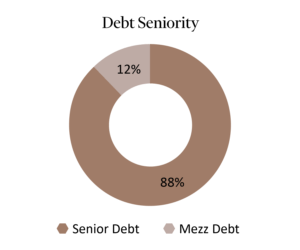

WCCF1 was sector-agnostic, primarily targeting senior secured, mid-market opportunistic credit opportunities across Australia.

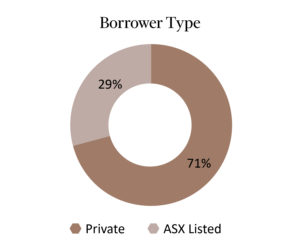

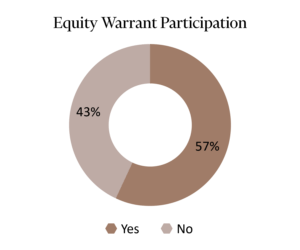

A Snapshot Of WCCF1’s Investments[1]

WCCF1 still holds equity warrants in a private business, which may provide additional upside in the future.

Looking forward

Looking ahead, we are preparing to launch our first evergreen, open-ended private credit fund: the Wingate Corporate Horizon Fund (Horizon). This fund will offer co-investors access to a diversified portfolio of high-quality direct lending and structured credit opportunities, targeting a return of 1-month BBSW + 6% p.a. (pre-tax, net of all fees and expenses).[1] Register your interest in Horizon here.

Wingate Corporate Horizon Fund

The fund is grounded in our experience through our WCCF series. The key highlights are:

- Diversified fund: Wingate’s first open-ended fund dedicated to corporate private credit, leveraging our track record across direct lending and specialised finance investments

- Target return: 1-month BBSW + 6%+ p.a.([2]) net return (post all fees and expenses), equating to ~10.3% as at September 2024

- Seed portfolio: Access to an attractive pool of seed portfolio assets held by existing Wingate funds, generating net returns (pre-tax, net of all fees and expenses) of 10%+ p.a.

- Proprietary deal flow: Access to unique opportunities through strong market relationships

- Differentiated expertise: Led by Managing Director Selwyn Schroeder, WCI has extensive experience in complex credit situations, ready to navigate the uncertain economic backdrop

- Attractive segment: Defensive asset class providing strong risk-adjusted returns and downside protection with lower volatility than public markets([3])

- Quarterly distributions: Realised net income with the option to reinvest

- Fees: 1.25% p.a. management fee of Horizon's net asset value and a 20% performance fee on returns above BBSW + 4% p.a., subject to a high water mark. Additional fees may apply ([4])

- Alignment with Wingate: Significant investment from Wingate in Horizon

Notes

[1] Industry / Seniority weighted by Facility Limits. Borrower Type / Equity Warrant Participation weighted by number of Facilities.

[2] Based on a pre-tax target of 1m BBSW + 6% p.a. (net of fees and expenses). This is a target only and Horizon may not be successful in achieving these returns.

[3] Investments are still subject to risk. Please refer to the Risk Factors section of the Information Memorandum, when available, for more detail.

[4] Please see the Information Memorandum, when available, for further detail. Wingate and its affiliates may be entitled to deal establishment and arranger fees in respect of investments of Horizon. Such fees will be allocated 50% to Horizon for the benefit of the co-investors.

IMPORTANT NOTICE

This document has been prepared by Wingate Corporate Investments Pty Ltd ACN 632 532 (WCI). WCI is a corporate authorised representative of Wingate Financial Services Pty Ltd ACN 106 480 602, AFSL No. 276899.

None of WCI, its directors, officers, employees or related bodies corporate (together, Wingate) warrant or represent that the information, recommendations, opinions or conclusions contained in this document are accurate, reliable, complete or current. The information is indicative and prepared for information purposes only and does not purport to contain all matters relevant to any particular investment or financial instrument. Some of the information in this document may be drawn from reports or other information provided to Wingate by third parties. Wingate is not responsible for any third-party material quoted or referenced in this document (including any website links).

The information and research in this document does not take account of any individual’s objectives, financial situation or needs. Wingate recommends individuals obtain relevant financial, professional, legal or other advice before making any financial investment decisions. Individuals should consider all factors and risks before making a decision. To the maximum extent permitted by law, Wingate excludes and disclaims all liability (including liability to any person by reason of negligence or negligent misstatement) for any expenses, losses, damages or costs arising out of the use of all or any part of the information in this document.

The information in this document is not intended to create any legal or fiduciary relationships and nothing contained in this document will be considered an invitation to engage in business, a recommendation, guidance, invitation, inducement, proposal, advice or solicitation to provide investment or financial services or an invitation to engage in business or invest, buy, sell or deal in any securities or other financial instruments.

Wingate has established and implemented a conflicts policy, which may be revised and updated from time to time, pursuant to regulatory requirements, which sets out how Wingate must seek to identify and manage all material conflicts of interest. Wingate may have conflicting roles in the financial products referred to in this research and, as such, may affect transactions which are not consistent with the recommendations (if any) in this research. Wingate’s employees or officers may provide oral or written opinions to its clients which are contrary to the opinions expressed in this research.

This document must not be provided to any person located in a jurisdiction where its provision or dissemination would be unlawful.

This document may not be reproduced, distributed or published in whole or in part by any person for any purpose without the prior express consent of Wingate.